Contents

- Introduction [1]

- The Stock Rover Dashboard [2]

- My Collections (Deep Research Tools) [7]

- Portfolio Analytics (Risk & Reward) [11]

- Value Over Time [12]

- Table [13]

- Price Change [14]

- Value Over Time [15]

- Risk and Reward [16]

- Table [17]

- Price Change [18]

- Value Over Time [19]

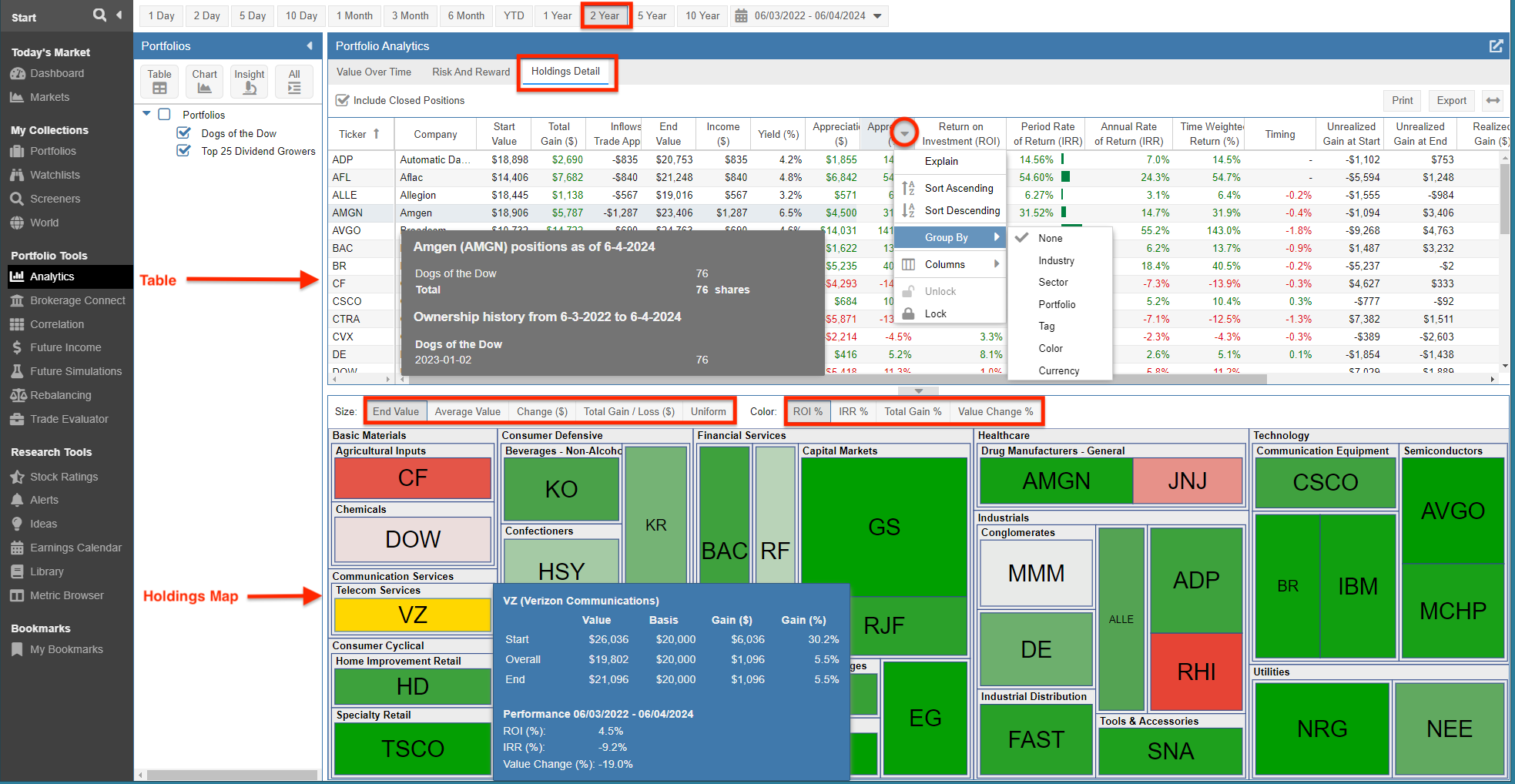

- Holdings Detail [20]

- Table [21]

- Holdings Map [22]

- Value Over Time [12]

- Email Portfolio Performance [23]

- Alerting [24]

- Summary [25]

- Frequently Asked Questions [26]

Introduction

Understanding how your portfolios are performing is critical to helping you make sound investment decisions and for prudent portfolio management.

Manually tracking portfolio performance can be a daunting task. It becomes even more complicated when multiple brokerages enter into the equation. For example, you could track some basic portfolio performance metrics by maintaining an elaborate spreadsheet, but this is both time-consuming and error-prone. Plus, tracking key portfolio performance metrics such are risk adjusted return and volatility would likely be beyond the capabilities of spreadsheet tracking.

This article will focus on the Stock Rover features that help you keep track of your portfolios. We will explore features like the dashboard, portfolio research, in-depth portfolio analytics, automated emailed performance reports, and alerting.

Note: Some of the features outlined below require a Premium or Premium Plus subscription, please see Compare Plans [30] for details.

The Stock Rover Dashboard

The Stock Rover Dashboard [31] is available to all Stock Rover subscription plans and delivers a performance overview of your portfolios as well as that of the overall market.

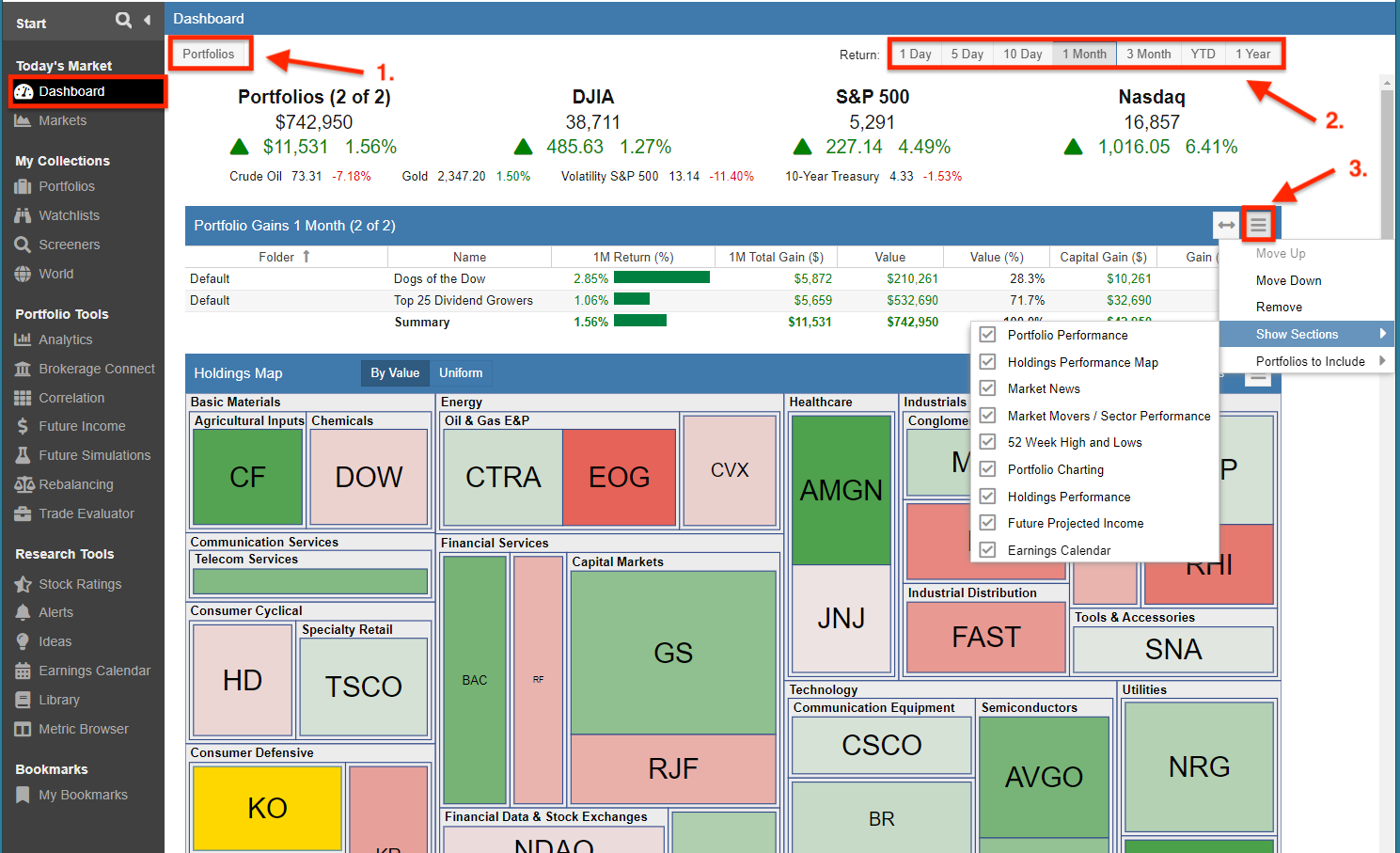

The Dashboard is highly configurable:

- Select [32] which portfolios to show

- Select the time period to analyze

- Arrange [33] the sections to display

The Dashboard sections specific to portfolio tracking are:

- Portfolio Performance

- Holdings Performance Map

- Portfolio Charting

- Holdings Performance

Portfolio Performance

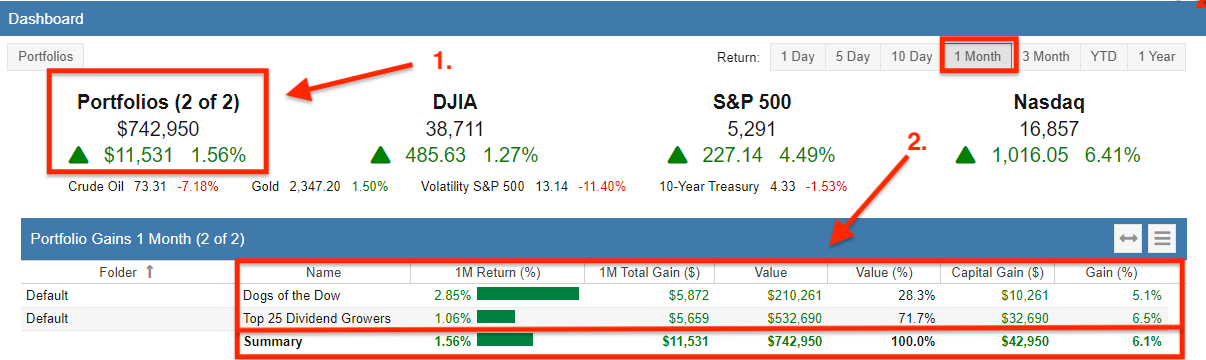

The section displays performance at the portfolio level, showing the Total Gain for the selected time period. The screenshot below has selected the one month return period.

- Shows the Gain for the portfolio(s) for the return period

- Displays the Return, the Value, and the Gain for each portfolio

Holdings Performance Map

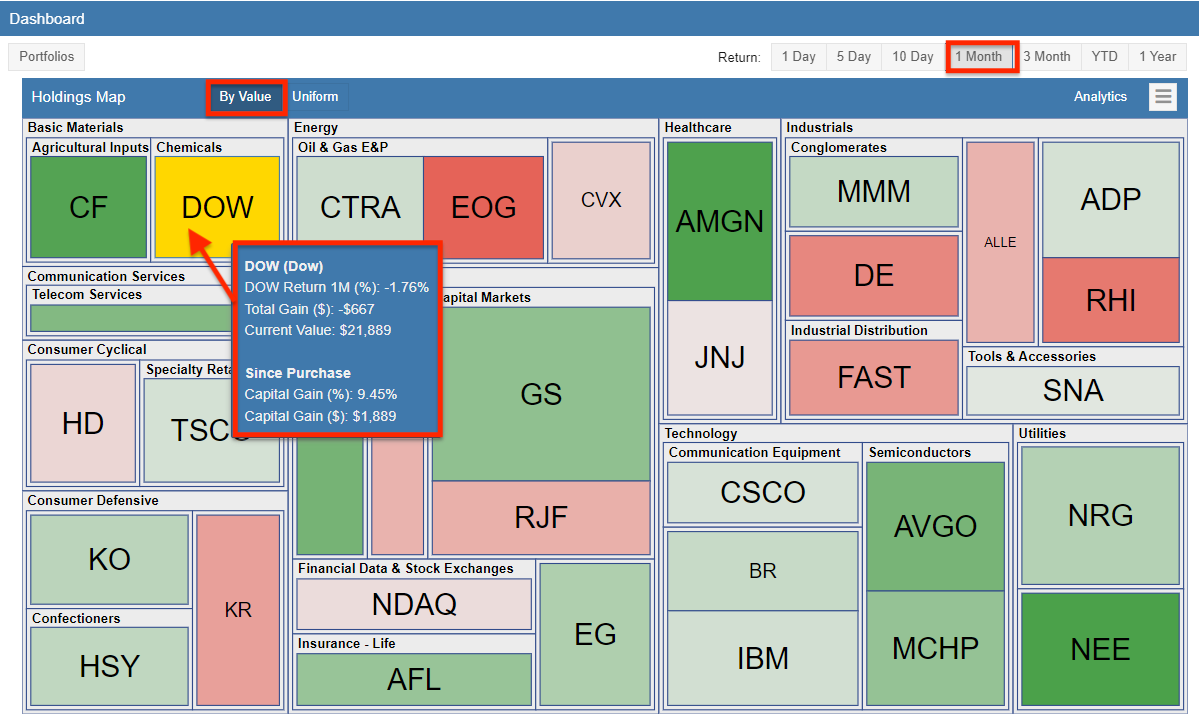

This section displays a heatmap of portfolio(s) holdings grouped by sector and industry.

When “By Value” is selected the size of each rectangle corresponds to the total dollar value for the ticker across the selected portfolios. The color of the ticker reflects the performance for the time period. Clicking “Uniform” switches so that the rectangles for each stock are the same size. Hovering over a rectangle shows the ticker’s performance for the selected time period.

Portfolio Charting

This section displays both the Dividend Adjusted Return and the Value Over Time of your selected portfolio(s). You can hover over either chart to see a moment-in-time dividend-adjusted return or dollar value.

Dividend-Adjusted Return – charts the performance across your selected portfolios for the selected time period. The hamburger provides additional configuration options, including the ability to add benchmarks. In the example below, the S&P 500 was added to the chart.

Value Over Time – charts the combined dollar value of your portfolio(s) over the selected time period.

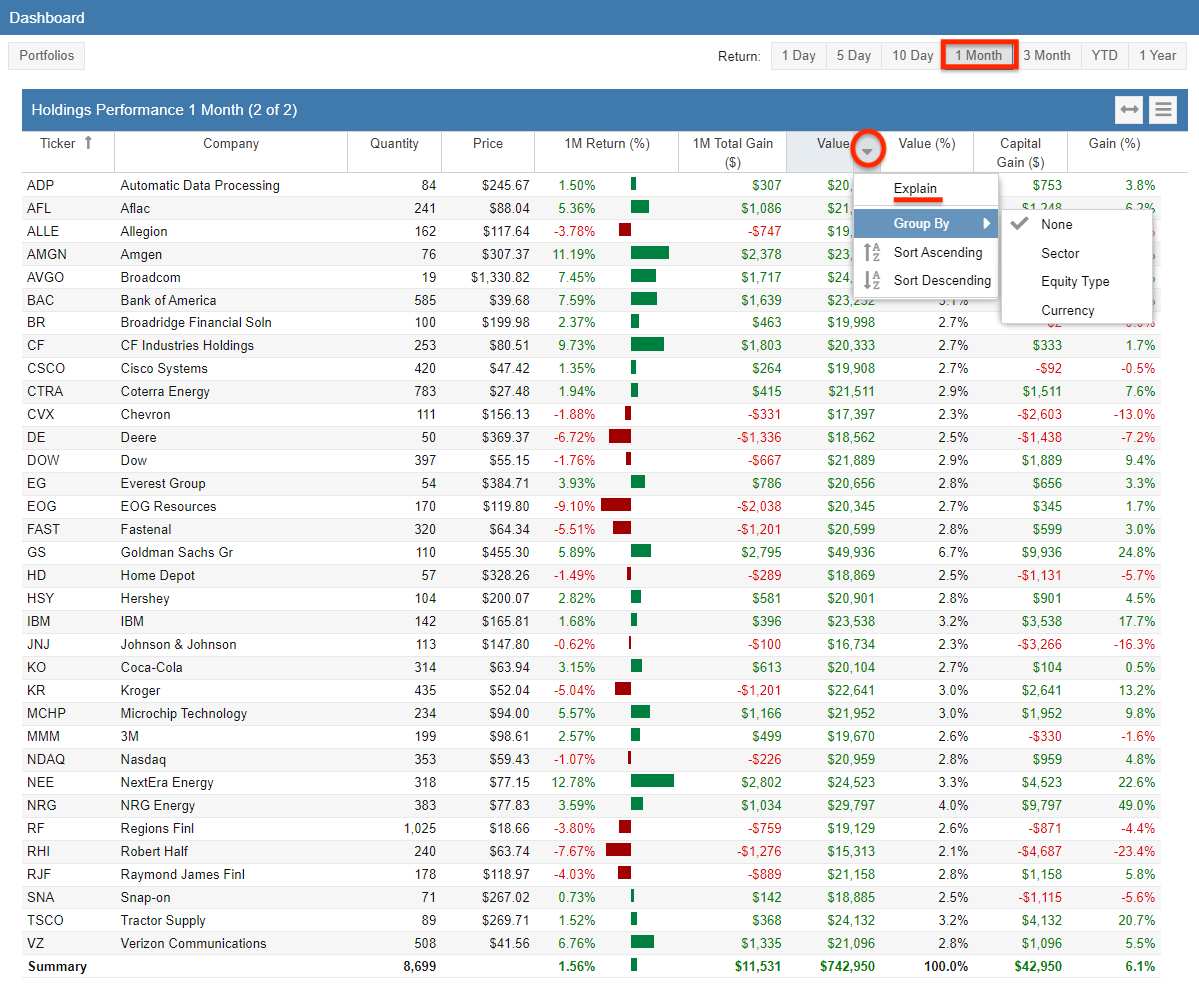

Holdings Performance

This section shows you in tabular form the Return, the Value, and the Total Gain at the position level, aggregated across your selected portfolios for the selected time period. In addition, the Capital Gain – the price appreciation since purchase is displayed. Right-clicking on a column heading allows for grouping by sector, equity type, or currency, as well as sorting.

Tip:

When viewing any of the tabular displays, you can right-click on the column heading and select Explain [39] for a definition of the column metric.

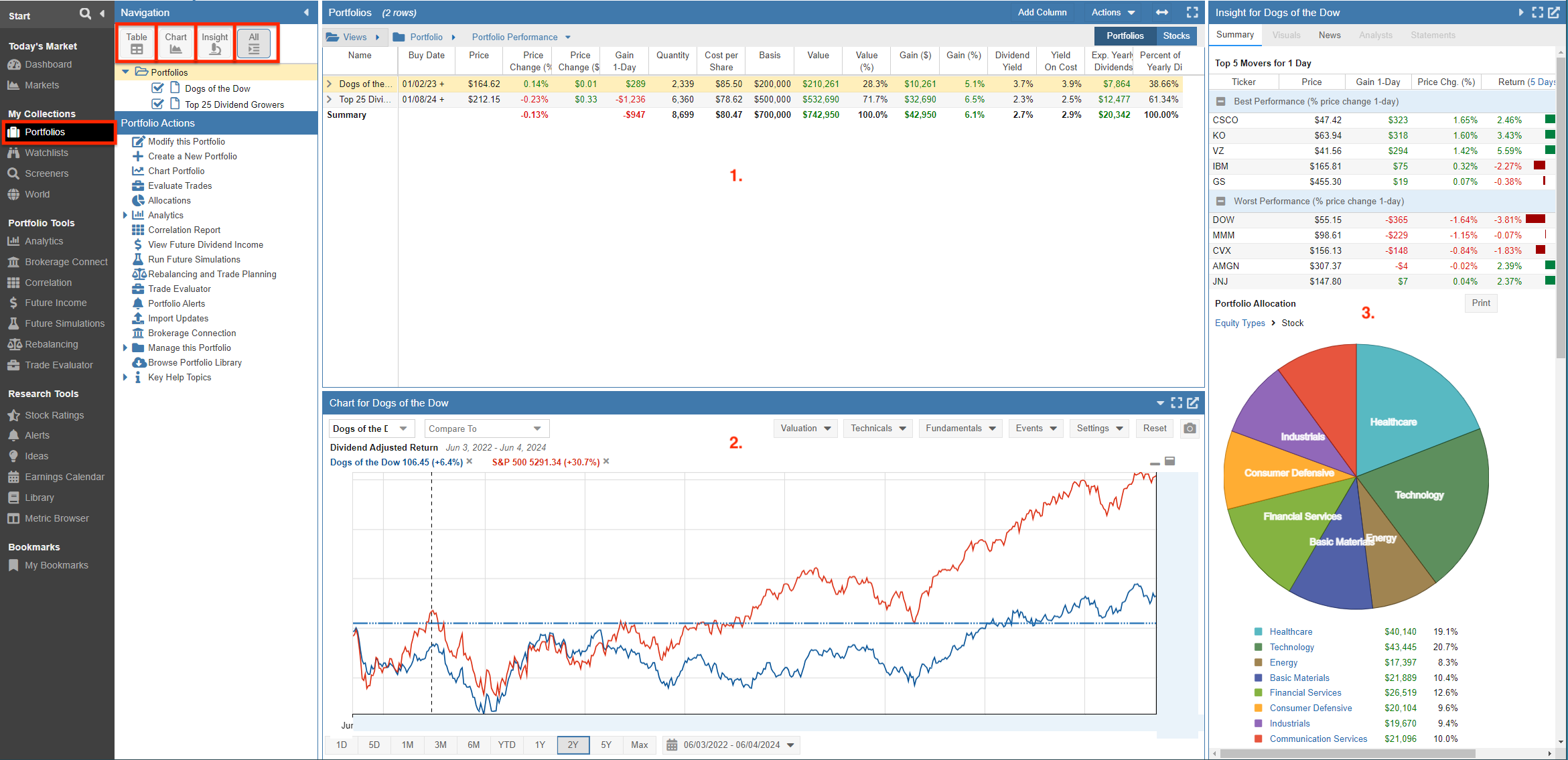

My Collections (Deep Research Tools)

More portfolio tracking is available via the selections listed under the My Collections group in the Start Menu.

- Table [40] provides a flexible spreadsheet for viewing portfolios and their data

- Chart [41] offers powerful capabilities such as benchmarking. You can also add events to charts like max drawdown

- Insight [42] contains tools for researching portfolios in depth

- All displays the Table, Chart, and Insight together

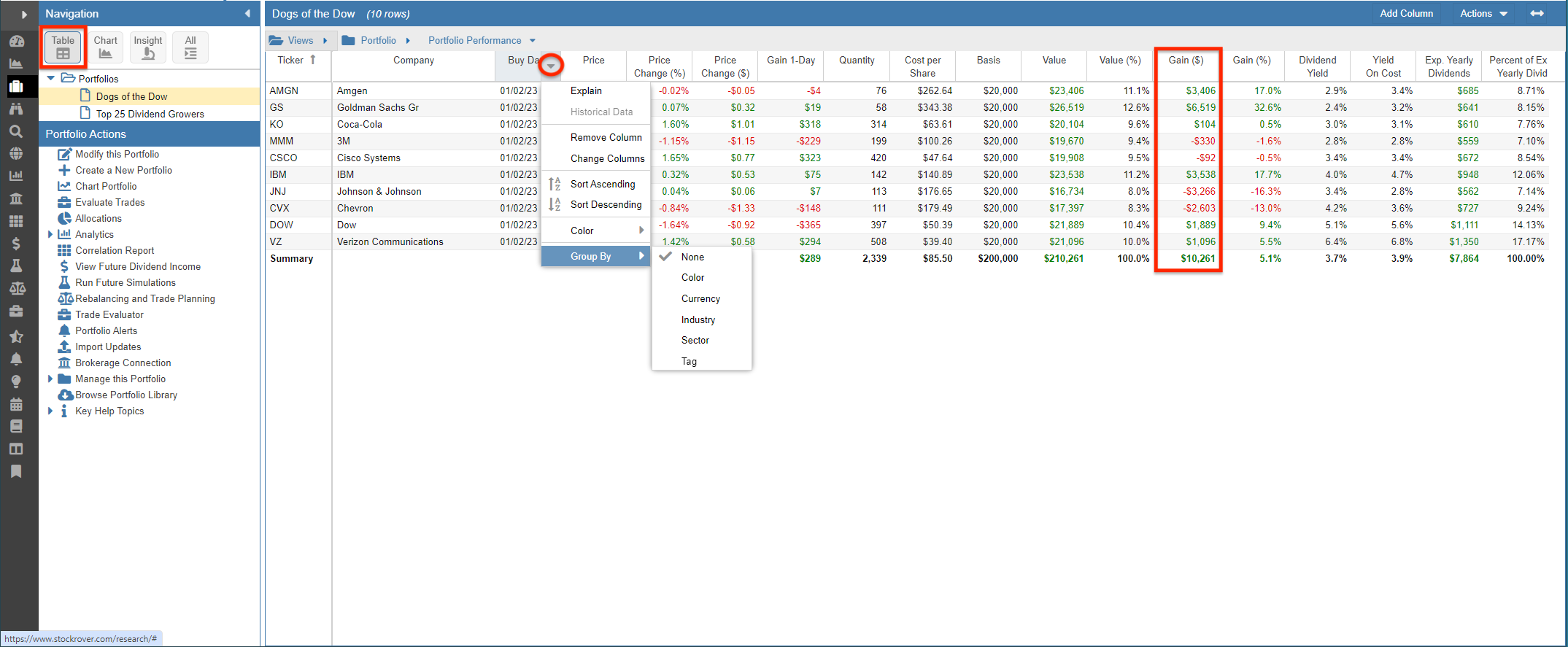

Table

Within the Stock Rover Table, the “Portfolio Performance” View [44] is a moment-in-time display that shows the performance of the current holdings in the portfolio(s).

As the Table is a moment-in-time display – the purchase and sale of equities are not considered as part of the Table’s calculations. For example, the column Gain ($) is simply displaying the difference between the purchase price and the current market value of each position.

Right-clicking on the column headers reveals additional options for displaying historical data [45], removing and changing columns, sorting, and grouping.

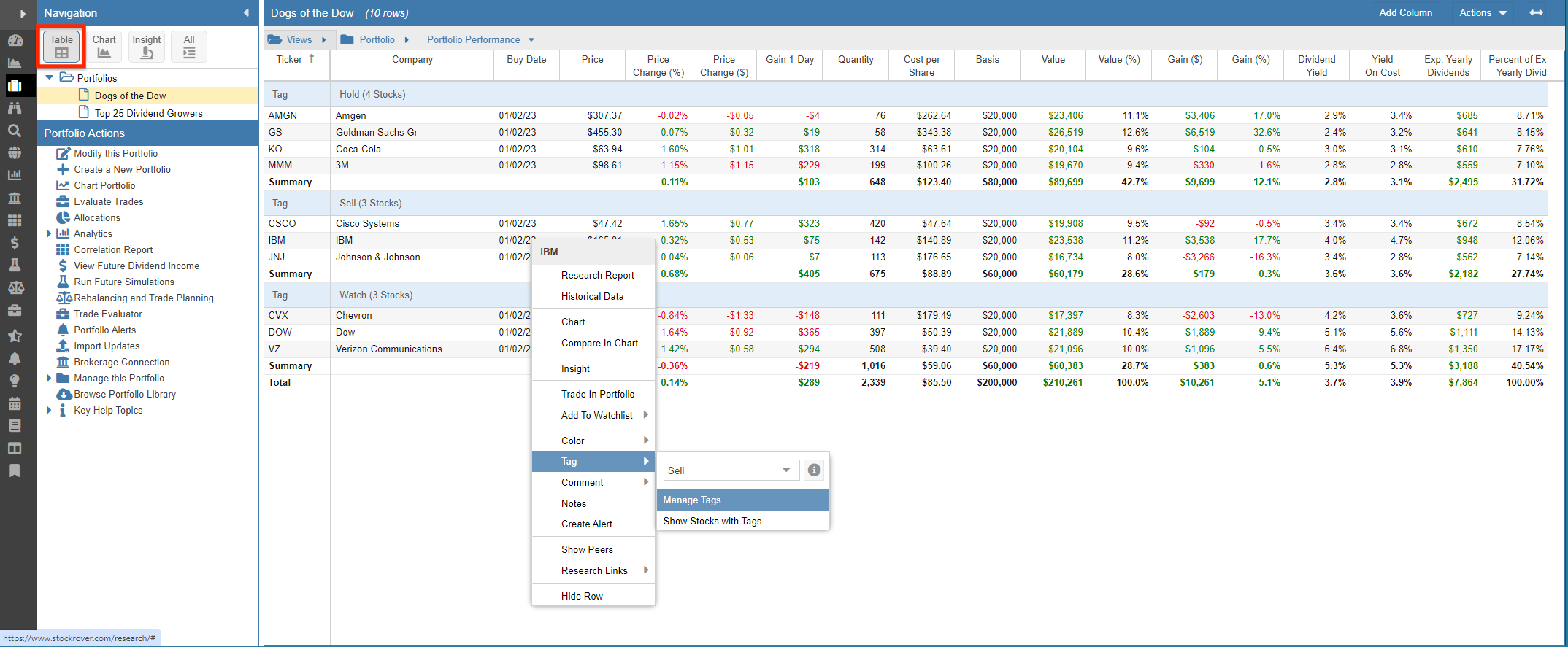

Right-clicking on a row in the Table provides a number of additional tracking options. You can add comments and notes [47] for the selected tickers. You can also color and tag [48] tickers and then using the grouping [49] option to change the Table to display your portfolio holdings grouped by color or tag.

In the example below, we see how tagging makes it easier for you to view your portfolio holdings based on your own categorization.

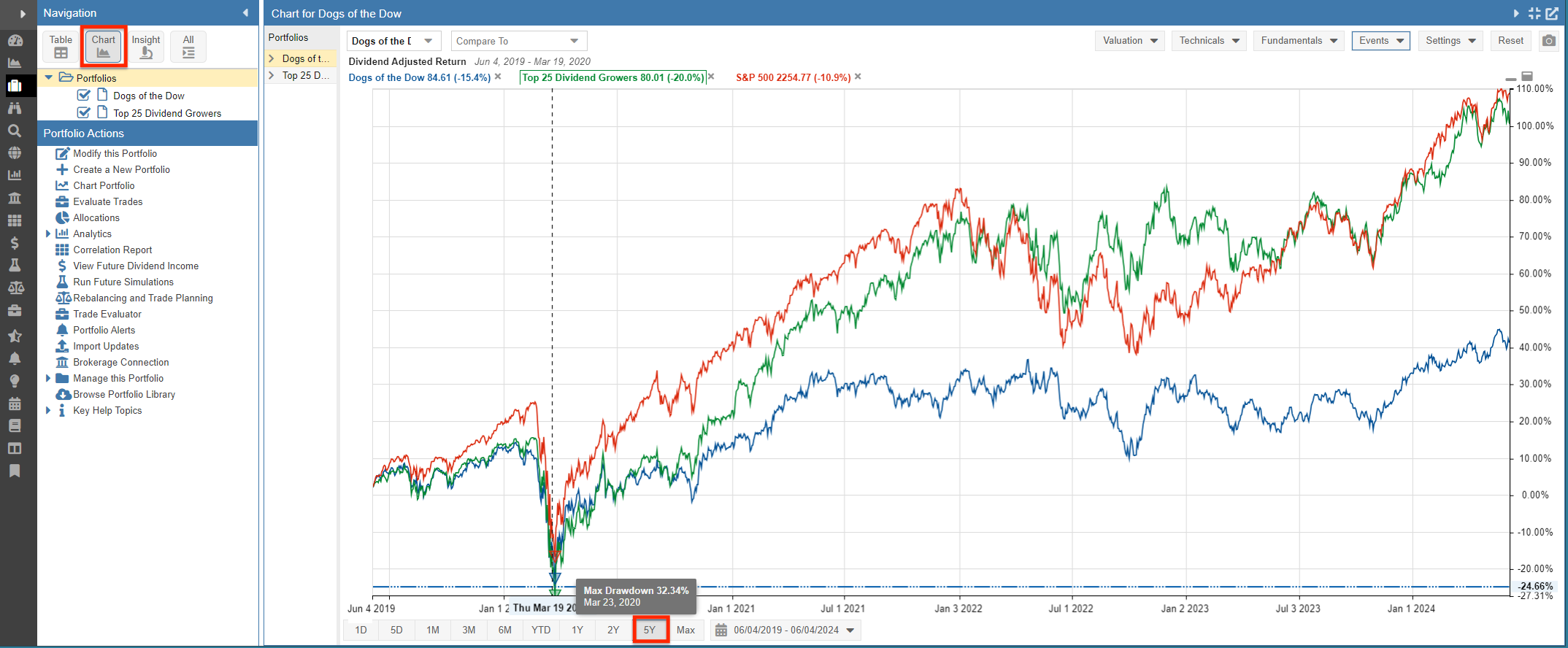

Chart

Stock Rover charts portfolio return values based on the weighting of each ticker in the portfolio. The weighting is based on the value of the holding of that ticker relative to the value of the overall portfolio. In addition, the portfolio charting accounts for trades, as it looks at the holdings of the portfolio on each date in the charting period to calculate return.

When calculating return, portfolio charting uses a time-weighted return, meaning the percent change on every day is equally weighted, regardless of the relative dollar amount in the portfolio.

In the example below, the individual returns of multiple portfolios are plotted along with the S&P 500 as a benchmark [51] for a 5-Year period of time. In addition, the chart is configured [52] to display the max drawdown for the portfolios and the S&P 500.

You can also add additional comparison tickers in the chart to compare the portfolios’ performance to selected stocks, ETFs, other benchmarks, or even other portfolios.

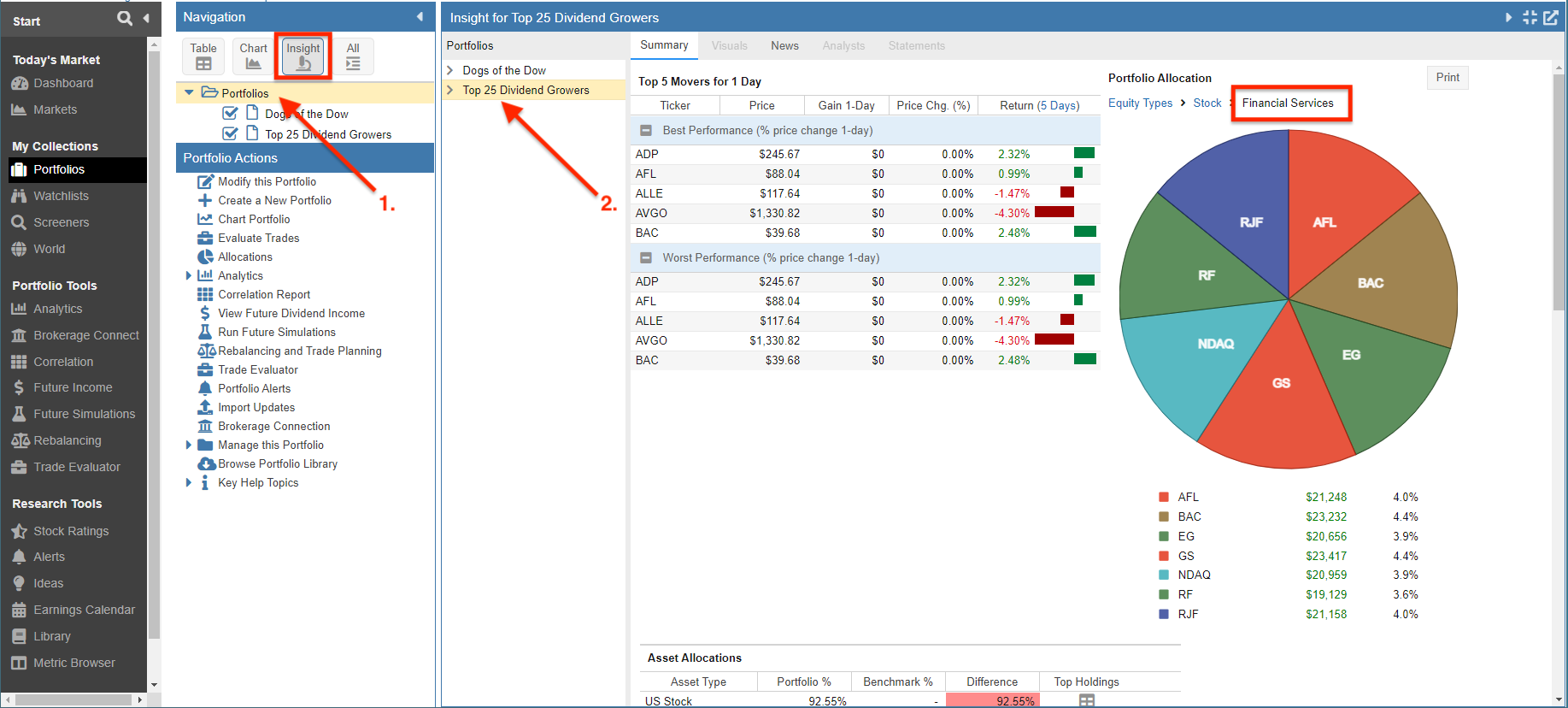

Insight

When a portfolio is selected from a folder, the Summary tab [54] in the Insight panel displays the top movers within the portfolio, as well as the portfolio allocation broken down by equity type for the portfolio. Drilling into the pie chart reveals more detail about what comprises each part of the pie. For example, we could drill on a Stock pie chart to reveal sectors, then drill on a sector to reveal the portfolio tickers in the sector.

In the example below we:

- Selected the Portfolios folder in the Navigation pane

- Selected a Dividend Growers portfolio from the Portfolios pane.

We now see the top movers as well as the portfolio’s breakdown of Financial Services stocks for the Dividend Growers portfolio.

Portfolio Analytics (Risk & Reward)

With Stock Rover’s Portfolio Analytics [56] tool, you can receive detailed analytics for any time period you choose, including the risk-adjusted return, volatility, beta, personal rate of return (IRR), Sharpe Ratio, component performance, and much more. The Portfolio Analytics facility leverages the entire portfolio history.

The detailed analytics are accessed via the following three tabs along the top of the tool

- Value Over Time

- Risk And Reward

- Holdings Detail

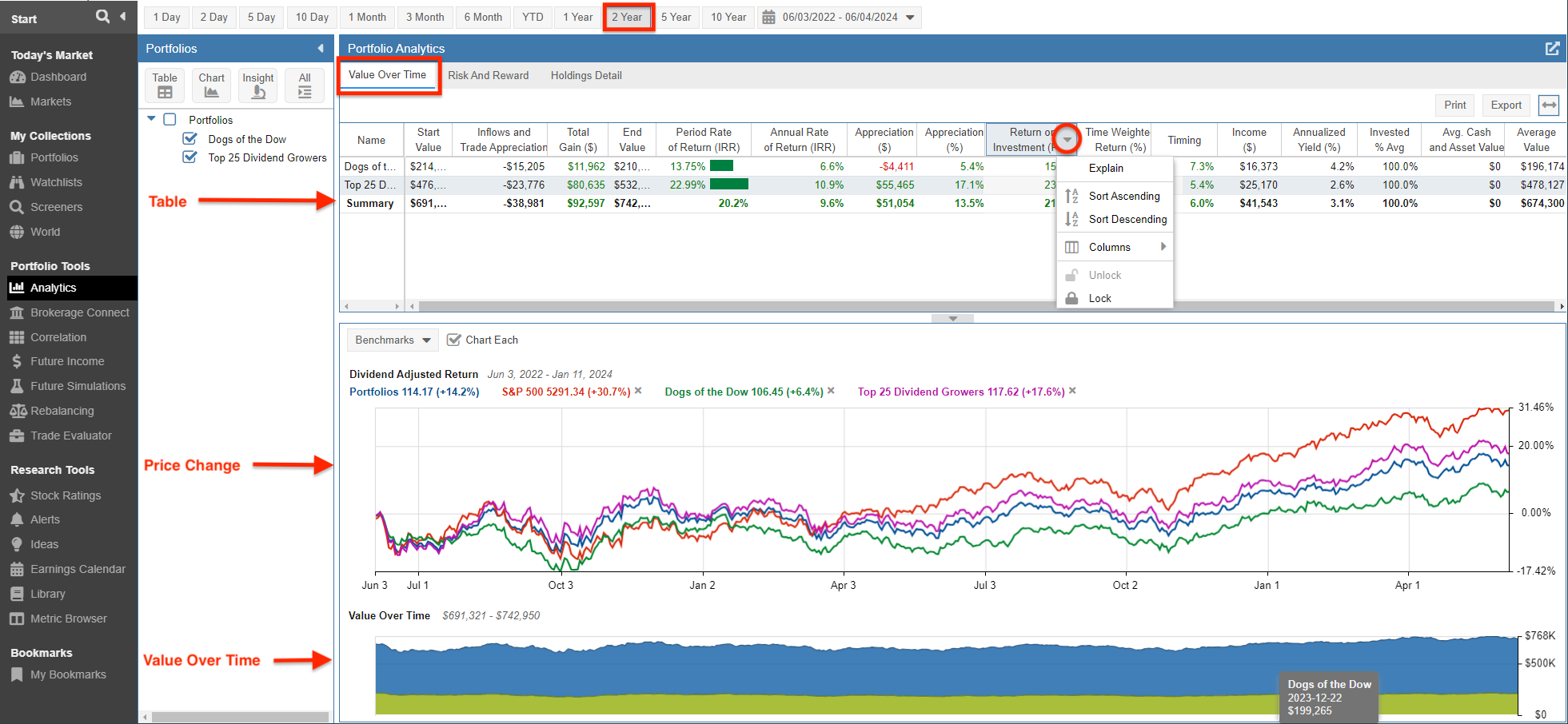

Value Over Time

The Value over Time tab shows you how the value of your selected portfolio has changed over the selected period of time, factoring in both inflows, outflows, and the underlying change in the value of the investments themselves.

Value over Time is divided into three separate sections. Each section is described in turn below.

Table

The top section is the table and it displays your portfolios’ values over the selected period. Right-clicking on any of the column headers configures sorting and which metrics to display.

Metrics include:

- Start value: The value of the portfolio at the beginning of the period.

- Inflows and Trade Appreciation: Additions of cash and value gained from trades.

- Total Gain ($): The absolute dollar gain over the period.

- End value: The value of the portfolio at the end of the period.

- Period Rate of Return (IRR): The personal rate of return for the specific period.

- Annual Rate of Return (IRR): The annualized personal rate of return.

- Appreciation ($) and (%): Increase in value of the assets.

- Return on Investment (ROI): The return percentage relative to cost.

- Time Weighted Return: Return calculation ignoring cash inflows/outflows.

- Timing: Effect of market timing decisions.

- Income ($): Dividends and interest received.

- Annualized yield (%): The hypothetical yearly yield.

- Invested % Avg: Average percentage of funds invested in the market.

- Average Cash value and Asset Value: Mean values over the timeframe.

- Average value: The mean total portfolio value.

Price Change

The middle section is the Price Change section and it charts the value-weighted average daily price change of the portfolio(s). The portfolios can be combined in one line or shown individually. Benchmarks can also be added. Hovering over the chart reveals a tooltip with the price change of your portfolios on a specific date.

Value Over Time

The bottom section is the Value over time section and it charts the value of the selected portfolios over time. Hovering over the chart reveals a tooltip with the value of your portfolios on a specific date.

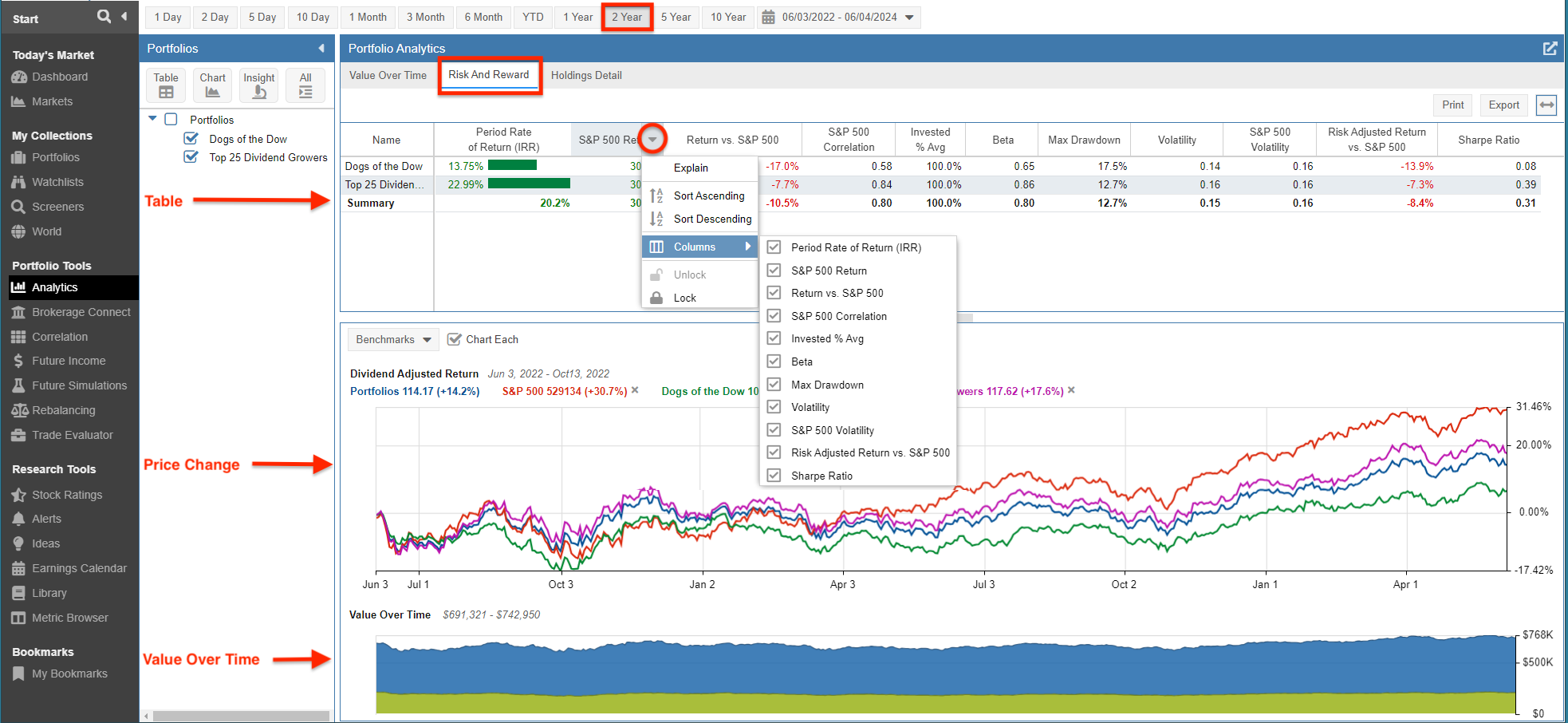

Risk and Reward

The Risk and Reward tab shows you the amount of risk you took to achieve your return. The display is divided into three separate sections. Each section is described in turn below.

Table

The table displays your portfolios’ risk values over the selected period. Right-clicking on any of the column headers configures the display. In our example, we are showing how to select which metrics to include in the Table.

Metrics include:

- Period Rate of Return (IRR): Your personal return for the period.

- S&P 500 Return: The benchmark return for the same period.

- Return of the Portfolios versus the S&P 500: Your relative outperformance or underperformance.

- S&P 500 Correlation: How closely your portfolio moves with the market.

- Invested % Average: Average exposure to the market.

- Beta: A measure of volatility relative to the market (1.0 is market match).

- Max Drawdown: The largest peak-to-trough decline.

- Volatility: The standard deviation of returns (risk).

- S&P 500 Volatility: The risk of the benchmark.

- Risk-adjusted return versus the S&P 500: Return per unit of risk compared to the market.

- Sharpe ratio: The average return earned in excess of the risk-free rate per unit of volatility.

Price Change

The charts section shows the value-weighted average daily price change of the portfolio(s). The portfolios can be combined in one line or shown individually. Benchmarks can also be added. Hovering over the chart reveals a tooltip with the price change of your portfolios on a specific date.

Value Over Time

The Value Over time section charts the value of the selected portfolios. Hovering over the chart reveals a tooltip with the value of your portfolios on a specific date.

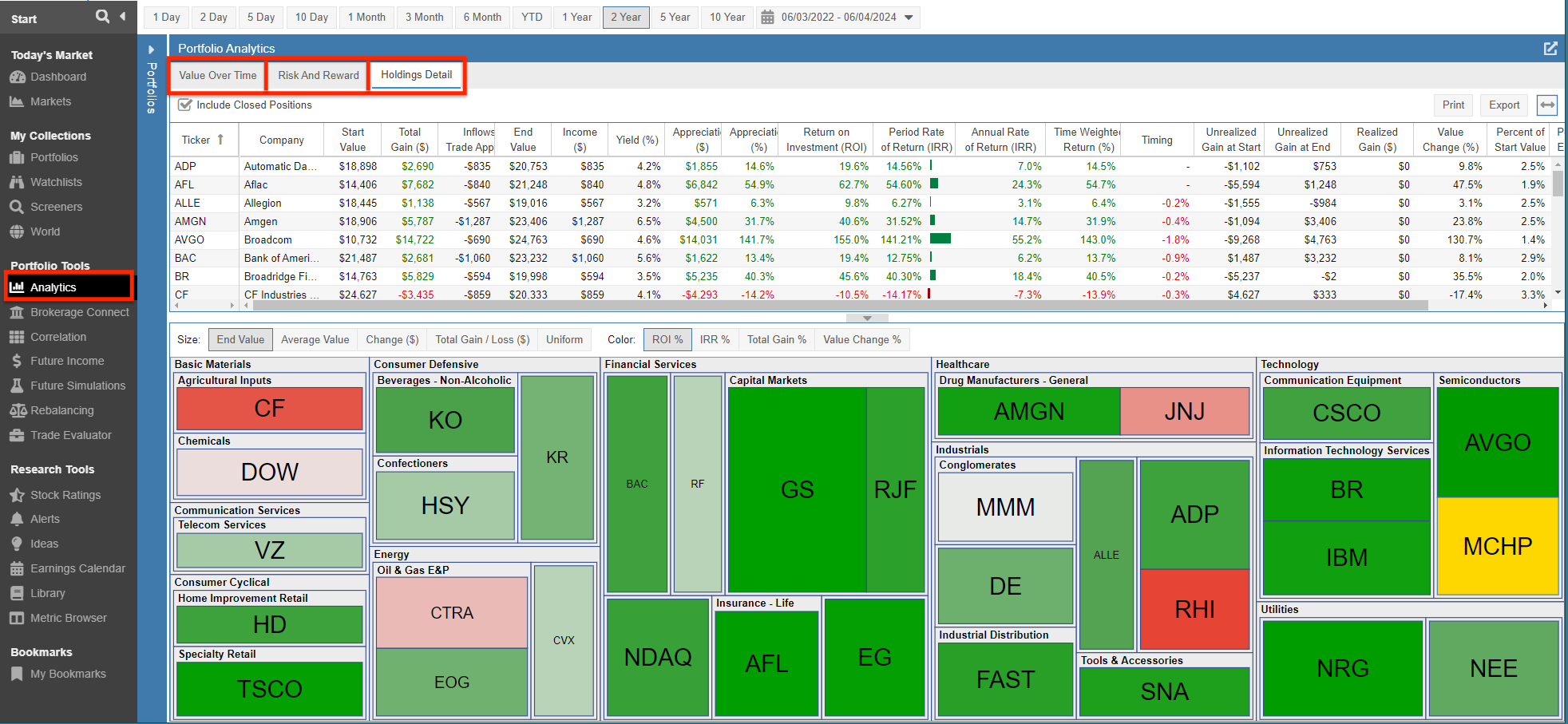

Holdings Detail

The Holdings Detail tab shows you the contribution of the different holdings of the selected portfolios to the overall portfolio return for the selected period of time. It includes any holdings you held during the period of reporting, not just the current holdings.

The Holding Details tab contains two sections, each of which is described below.

Table

The Table lists all of the holdings across all of the selected portfolios. Right-clicking on any of the column headers configures the display. In our example above, we are showing how to group the holdings in the Table. In addition, hovering over a ticker symbol will display a tooltip with more information about that holding.

The Table makes it is easy to see which positions are punching above their weight and which positions have been creating the most drag on portfolio performance.

Metrics include:

- Starting value

- Total Gain ($)

- Inflows and Trade Appreciation

- Ending value

- Income

- Yield (%)

- Appreciation ($) and (%)

- Return on Investment (ROI)

- Period Rate of Return (IRR)

- Annual Rate of Return (IRR)

- Time Weighted Return (%)

- Timing

- Unrealized Gain at Start and End

- Realized Gain ($)

- Value Change (%)

- Percent of Start Value

- Percent of End Value

- Percent of total return

Holdings Map

The Holdings Map displays a heat map of the selected portfolios. The heat map displays the portfolio tickers grouped by sector and industry. Hovering over a tile will display more information about that holding.

The tiles can be configured to be sized and colored with the following options:

Size

- End Value

- Average Value

- Change ($)

- Total Gain/Loss ($)

- Uniform

Color

- ROI %

- IRR %

- Total Gain %

- Value Change %

Email Portfolio Performance

You can configure your email preferences [61] to automatically generate and email portfolio performance reports. You can choose to have the report generated on a daily, weekly, or monthly basis.

The email example below is showing the Portfolio Summary section along with the Portfolio Returns section. Returns for each of the portfolios are displayed spanning 1-Week, 1-Month, 3-Month, YTD, and 1-Year time periods. In addition, Portfolio Movers shows the top movers for each of the portfolios.

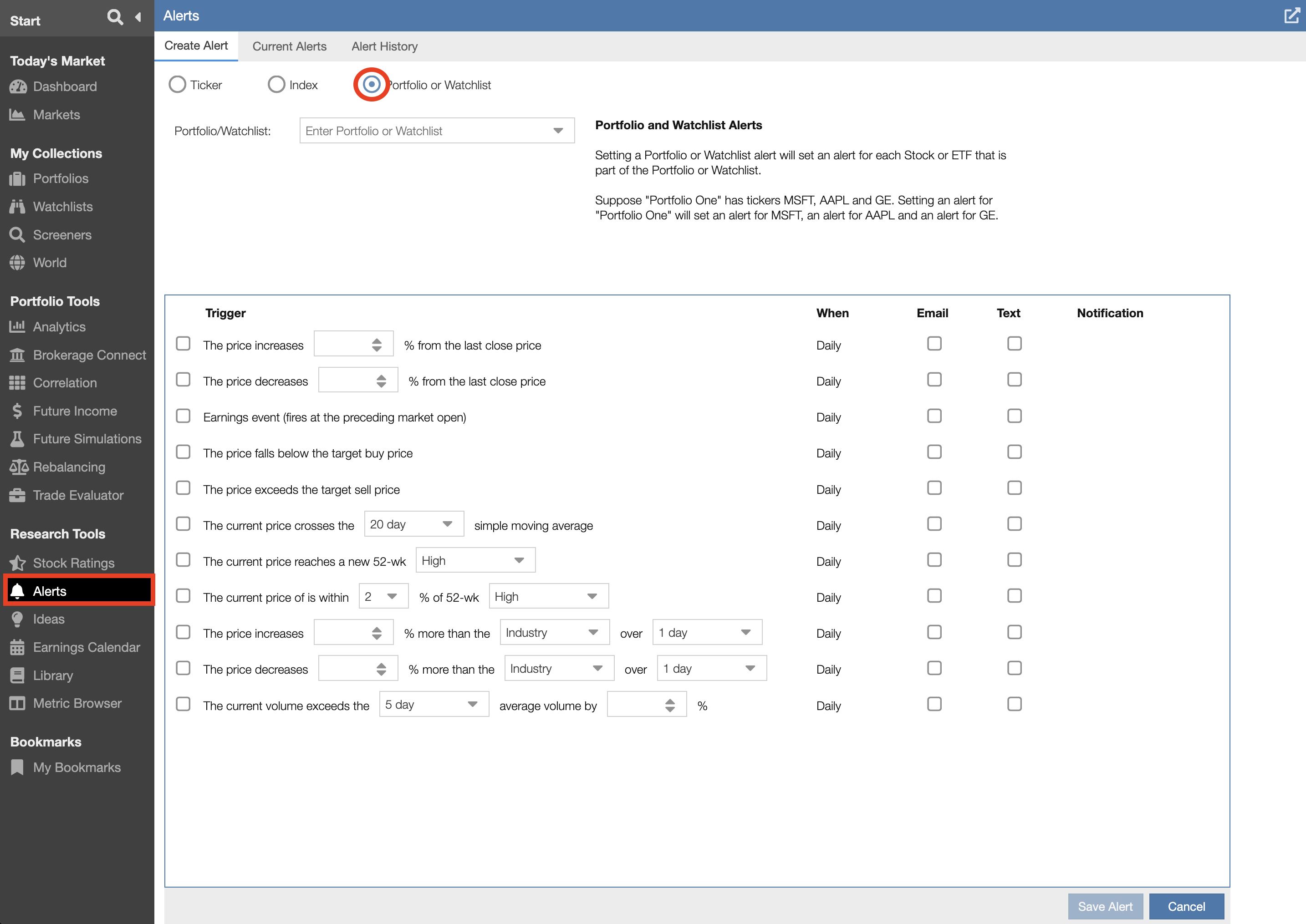

Alerting

Stock Rover’s Alerts Facility [64] sends email or text alerts when something you care about happens in your portfolio. You can be alerted on many different things, including a stock in your portfolio hitting a certain price level, prices approaching or reaching 52-week highs or lows, unusual volume, and stocks hitting your target buy and sell prices.

You can also receive alerts on upcoming earnings events as well as prices crossing their moving averages or stock overperformance or underperformance relative to their industry.

Summary

Portfolio tracking is an absolute necessity to ensure your portfolios are aligned with your long-term investment goals. In addition, constant monitoring helps identify any portfolio holdings that may be falling short of expectations. Stock Rover helps you keep tabs on your portfolio(s) in multiple ways.

The Dashboard provides a performance overview of your portfolio(s).

The Research section track your portfolios’ performance in depth via the Table, Chart, and Insights.

The Portfolio Analytics facility take a deep dive and analyze Value Over Time, Risk and Reward, and how the individual holdings contribute to overall portfolio return.

Emailed Performance Reports automates portfolio tracking by sending you detailed performance reports with the frequency that you desire; daily weekly or monthly.

The Portfolio Alerts facility provides a comprehensive alerting facility helps you keep tabs on all of the holdings in your portfolios by letting you know ASAP when something happens that you need to know about.

Frequently Asked Questions

Does the Stock Rover Table account for past trades?

No. The Table view is a “moment-in-time” display. It shows the performance of your current holdings based on purchase price vs. current price. To analyze performance that includes the impact of buy/sell trades over time, you should use the Portfolio Charting or Portfolio Analytics tools.

What is the difference between Time-Weighted Return and IRR?

Time-Weighted Return measures the performance of the underlying investments, ignoring the timing of your cash inflows and outflows. IRR (Internal Rate of Return), also known as your personal rate of return, accounts for the timing of your deposits and withdrawals. Stock Rover provides both metrics.

Can I track portfolios from multiple brokerages?

Yes. Stock Rover allows you to link multiple brokerage accounts via Yodlee integration. You can then view them individually or aggregated together in the Dashboard and Analytics tools to get a holistic view of your Net Worth.

Editor’s Note: This post was originally published in December 2022 and has been updated for freshness, accuracy, and comprehensiveness.

13 Comments To "Keeping Track of your Portfolios in Stock Rover"

#1 Comment By Yogesh Patel On December 17, 2022 @ 10:03 am

Hi, I would love to buy stockrover subscription and move from away M*. The one thing that’s bothering me is- when I sell a stock and enter that trade in your portfolio as “Sell” it doesn’t allow me to specify price I sold the stocks at. It does allow me to specify price when I Buy stock, but not when i sell. This makes my entries inaccurate for managing portfolio. Is there a reason why it’s setup that way? I am happy to provide a screenshot to explain my question.

#2 Comment By Howard Reisman On December 19, 2022 @ 7:10 am

It is setup this way because we use Yodlee for brokerage integration and they only provide end of day positional data, not individual transactions. So the Stock Rover software is set up to deal with the data in the form Yodlee provides it.

We understand the frustration of not being able to enter exact sell prices and next year we expect to provide an alternate approach for portfolios that don’t integrate with Yodlee.

#3 Comment By Yogesh Patel On December 18, 2022 @ 9:49 am

My comment disappeared. Maybe you are not interested in feedback.

#4 Comment By Howard Reisman On December 19, 2022 @ 7:07 am

Comments are reviewed by a human before they are posted on-line which can create a delay between posting them and seeing them.

#5 Comment By Ken Piehl On January 15, 2023 @ 4:04 pm

I have enjoyed your service in the past and am currently not a user. However, I would like to rejoin, but need to know if you have added the ability to track preferred stock and baby bonds?

#6 Comment By Ken Leoni On January 16, 2023 @ 11:10 am

You can screen and track preferred stocks, but bonds would need to be tracked as assets.

#7 Comment By JOHN SNADER On May 25, 2023 @ 3:30 pm

tried to enroll, did not receive start up Email. John Snader, [66]

new sign up says email all ready used. I’m stuck!

#8 Comment By Howard Reisman On May 26, 2023 @ 6:22 am

We have authenticated your account. Sorry for the difficulty.

#9 Comment By TR On July 10, 2024 @ 12:29 pm

It does not appear that the value summary provides an accurate total in the default or selected currency when I have holdings/portfolios in different currencies. So for example if I have 2 portfolios one USD and the other CAD, the total does not convert into a single currency. Am I missing something in the setup or configuration?

#10 Comment By Ken Leoni On July 11, 2024 @ 9:24 am

Hello,

The Value over Time tab in the Portfolio analytics does not convert currency.

The link below references a blog that shows how Stock Rover displays mixed currencies and demonstrate ways to effectively leverage the platform for multi-currency research and analytics.

[67]

Regards

Ken

#11 Comment By Donald E. L. Johnson On October 26, 2024 @ 9:50 am

As a very active trader of covered calls and cash secured puts, I have created spreadsheets for tracking those trades by the month going back about 16 years.

More people are trading options these days. Does StockRover have any plans to serve options traders?

#12 Comment By Howard Reisman On October 27, 2024 @ 6:01 am

It is on our futures list to address as we are fully aware the area is important to many investors.

#13 Comment By Jon Dearborn On October 26, 2024 @ 5:10 pm

Outstanding. Thank you.